1. Overview

1.1 Purpose

This guide is designed to meet the payment requirements of enterprises in China and abroad while it also define the regulation and business operation standard which enterprises should follow with。

1.2 Scope of Application

This guide is meant for enterprises that use the cross border B2B payment Service platform (hereinafter referred to as B2B platform) for collection.

1.3 Product Definition

B2B Platform provides two kinds of products: one is direct payment for online B2B trade platform and another is E-invoice payment for order platform and traditional export enterprises.

Direct payment:This product is intended for those online B2B trade platforms or order platforms. Enterprises get access to B2B Platform, and after purchasers create orders on online B2B trade platform, they will be redirected to the B2B Platform to make the payment.

E-invoice payment:E-Invoice Payment is another kind of collection product mainly available for traditional export enterprises without Internet E-commerce front-end online system. Registered users can get access to the system via B2B Platform, they can create unpaid orders based on the trading contract for the buyer to make payments.

2. Requirements to join the B2B Platform

2.1 Enterprise Type

Traditional export enterprises:Traditional export enterprises refers in particular to export enterprises, trade companies or manufacturers that confirm trading contract with buyers through a traditional method.

2.2 Enterprise Qualification

Enterprises that get access to the B2B Platform should meet the following requirements:

• Have Business License and relevant Tax Registration Certificate

• Have stable business place and legal internet portal

• Have stable business place and legal internet portal

• Not listed in the national or local relevant departments’ blacklist; not entered as a “ suspectable merchant” in UnionPay

International Risk Information Sharing System

• Ranked as Category A export enterprises in the list of revenues and expenditures enterprises in foreign exchange

2.3 Application Process

2.3.1 Submit Materials

Before using the Cross-border B2B Payment Service Platform, enterprises need to register their own platform user account and submit copy of enterprise qualification materials, including but not limited to:

• Copy of Business License(integrate the business license the organization code certificate and the certificate of taxation registration

into one document)

• Corporate Certificate and Identity Card

• Customs Record Certification

• Letter of Authorization and registrant’s identity materials(should be provided when the registrant is not the legal person)

• Certification of Category A export enterprises in the list of revenues and expenditures enterprises in foreign exchange

• Other documents that help to prove the import and export qualification of the enterprise, as well as trading contracts

UnionPay International will require enterprises to provide, add or update some or all of the above materials. Enterprises have to keep these materials for 5 years for future reference, including but not limited to contract, receipt and declaration for exportation, etc.

2.3.2 Requirement for Materials

Enterprises have to guarantee authenticity, legality and integrity of the submitted materials.

2.3.3 Inspection for Qualification

UnionPay International and acquirers for the export enterprises will inspect required enterprise qualifications. On the premise that enterprises do not violate mentioned regulations, if inspection result from acquirers shows that there exist cases against this guide, UnionPay has the right to take corresponding measures, including but not limited to demand enterprises to add or update information, suspend or terminate B2B Platform Services for enterprises.

3. Collection Requirements for Export Enterprises

3.1 Applicable Cards

UnionPay cards issued out of China.(For the purpose of this guide, including Hong Kong, Macao and Taiwan).

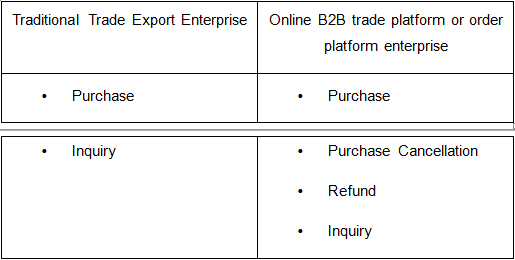

3.2 Transaction Type

For the traditional export trade and online B2B trade platform or order platform enterprises, the collection products provided by Cross-border B2B Payment Service Platform is slightly different in terms of transaction support, as follows:

3.3 Trading Authenticity

Export enterprises must guarantee authenticity and legality of trades paid via B2B Platform. Document and certificates must be real and effective, and support acquirers’ work such as inspection of relevant document and investigation of unusual transactions.

3.4 Transaction Channel

Cross-border B2B Payment Service Platform

3.5 Payment Process and Requirements

Export enterprises can make collections by jumping from online B2B trade platform to B2B Platform (Direct Payment) or by generating orders to be paid via B2B Platform and send them to the buyer to make online payments (E-invoice payment). Specific process and requirements can be seen in 3.5.1 and 3.5.2

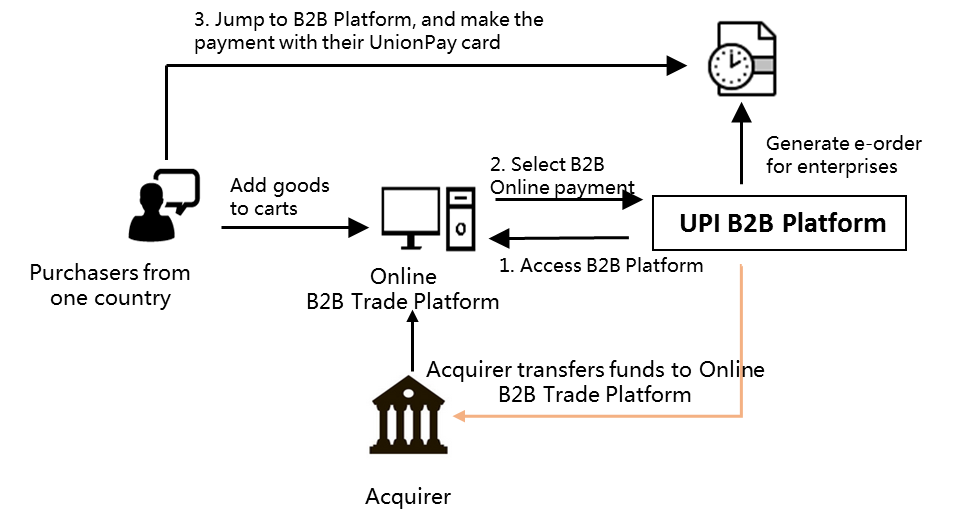

3.5.1 Direct Payment

Direct Payment is intended for those online B2B trade platform or order platform enterprises. The figure below illustrates the main process of Direct Payment:

Process Description:

1. When purchasers from another country make payments on online B2B trade platforms, the online automatically jump to the B2B Platform cashier, where purchasers can enter the UnionPay card number, expiration date, phone number, and fill in the SMS code and other payment information.

2. The B2B Platform will send transaction information to issuer for verification and give the payment result back to the system of online B2B trade platform.

3. Acquirer of online B2B trade platform enterprise transfers funds that’s been successfully paid to the enterprise via UnionPay network.

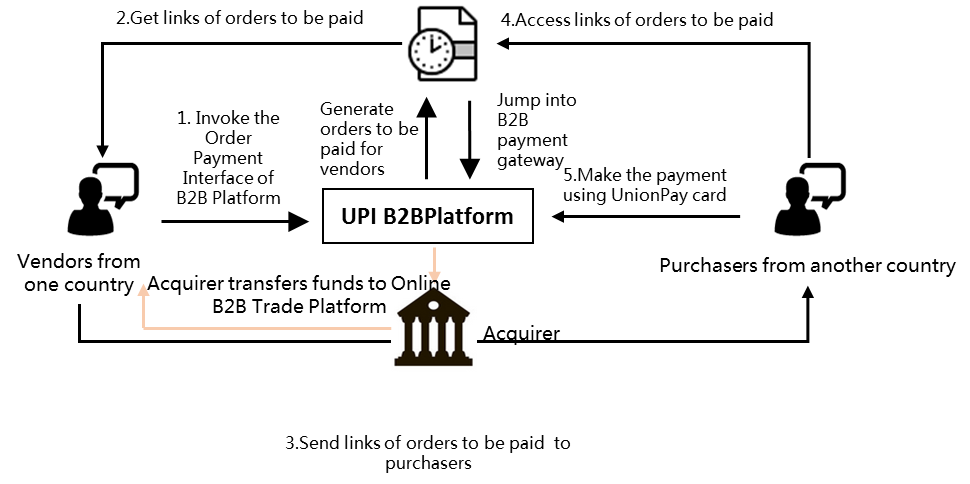

3.5.2 E-invoice Payment

E-invoice Payment is mainly available for traditional trade export enterprises without Internet E-commerce front-end online system. By accessing the B2B Platform directly as users or invoking the order payment interface, enterprises can generate orders to be paid based on the trading contract for the buyer to make payments. The figure below illustrates the main process of E-invoice Payment.

Process Description:

1. Traditional trade export enterprises register at B2B Platform, log in the Platform or access the system, generate orders to be paid with the E-Invoice payment interface of B2B Platform, then the B2B Platform returns links of these orders to them;

2. Traditional trade export enterprises can send purchasers (the buyer) links of orders to be paid by mail or other means of communication;

3. The buyer may access these links through the Internet, which will lead to jump into B2B platform cashier, where purchasers can enter the bank card number, expiration date (required for credit cards), phone number, fill in SMS code, then submit payment information;

4. The B2B Platform finishes the verification of payment information as well as payment transaction. B2B platform will provide the payment status inquiry;

5. Acquirer of online B2B trade platform enterprise transfers funds that’s been successfully paid to the enterprise via UnionPay network.

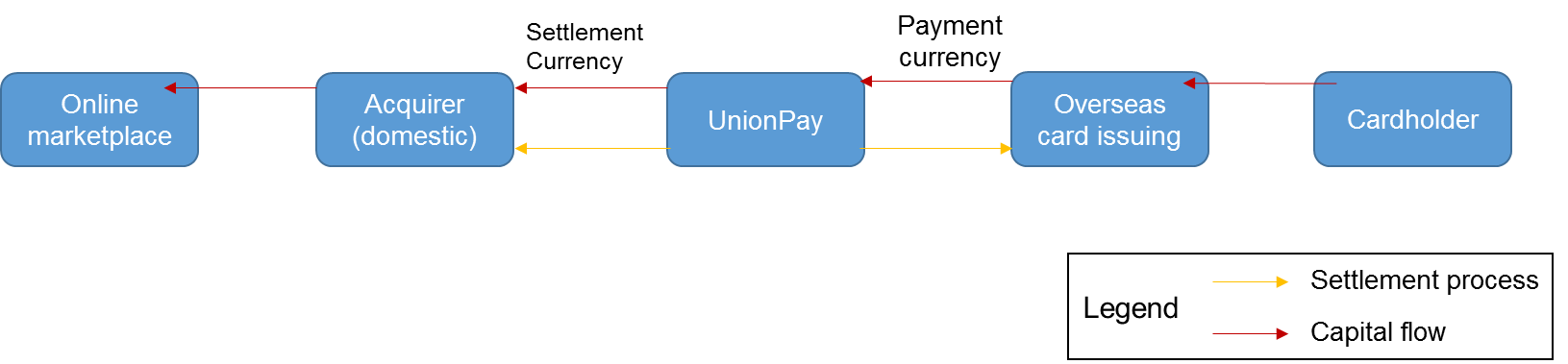

4.Clearing & Settlement process

The clearing & settlement process is illustrated below:

5.Dispute Resolution

5.1 Traditional export enterprises

• Provide E-Invoice Payment product

• B2B Platform only provide cross-border payment service, export enterprises and purchasers should meet contractual obligations (including payment). Both sides should deal with any dispute relevant to the contract properly according to the contract.

5.2 Online B2B trade platform or order platform

• Provide Direct payment product

• If there occurs a dispute relevant to Direct Payment under this guide, enterprises should contact acquirers in a reasonable period. The acquirer should deal with the dispute according to the dispute resolution process in UnionPay《Unionpay international business rules》.

6. Service Pricing

Enterprises negotiate the price with acquirers. The price is subject to the acquiring agreement。